- M&M Enterprises, Settlements Division

- M&M Enterprises, Scrip Clearing House Division

- M&M Enterprises, Registry Services Division

The second point is that most bourses allow short selling. I see no difference between short selling and the situation described in post #15. There is no real need to establish any type of insurance to cover the situation described in post #15, but for the more timid traders, I'm certain that M&M Enterprises, Reinsurance Division would cover any products developed and offered by M&M Enterprises, General Insurance Division to ally the fears of timid traders.

Rather than taking out some type of insurance (including any type of credit default swaps) the trader seeking peace of mind could undertake the traditional methods of:

- taking an opposite position relying on arbitrage to make a profit

- borrowing the underlying asset from M&M Enterprises, Virtual Shipyard Construction Division

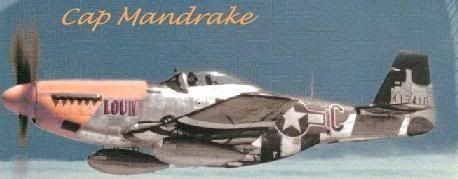

- transfer to WWII (d)

Bottom line is that with the highly integrated conglomerate and extensive business connections which characterise M&M Enterprises, I see no drawbacks but only opportunities for this wonderful new business opportunity.

Alfred